us japan tax treaty withholding rate

Protocol PDF - 2003. The US Japan tax treaty eliminates withholding taxes on dividends paid.

Singapore Japan Double Taxation Agreement

Tax Rates on Income Other Than Personal Service.

. India and USA subject to certain exceptions. February 21 2022. WHT at a rate of 25 is imposed on interest other than most interest paid to arms-length non-residents dividends rents royalties certain.

Article 11 of the United States- Japan Income Tax Treaty allows the source state to impose a withholding tax of 10 percent if paid to a resident of the other Contracting State that. Technical Explanation PDF - 2003. 10 for revenue bonds not exempt Effective from 1 November 2019 Uruguay 10 0 10 0 10 under certain conditions.

Income Tax Treaty PDF- 2003. With Regard to Non-resident Relatives. Foreign procedures for claiming reduced withholding are determined under the laws and practices of the treaty partner.

All persons withholding agents. Shark attack hollywood beach florida. Korea Republic of Last reviewed 01 June 2022 Resident corporation individual.

Outline of Japans Withholding Tax System Related to Salary The 2021 edition For Those Applying for an Exemption for Dependents etc. Japanese cfc taxation for the potential deferral may tax treaty withholding on your plans. In any inconvenience to treaty withholding tax rates as limit double tax rate applicable individual.

Support for the establishment and development of business between the US and Japan using intercompany loans has historically been disadvantaged by 10 withholding tax. While the US Japan Tax treaty is not the final word on how items of income will be taxed it does help Taxpayers better understand how either the US Government andor Japan will tax certain. This table lists the income tax and.

Is celebrity a luxury cruise line. Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of ratification and applies to withholding taxes on dividends and. If you claim treaty benefits that override or modify any provision of the Internal Revenue Code and by claiming these benefits your tax is or might be reduced you must attach a fully.

Of the treaty for double taxation between USA. 0 14 for individual 14 for distribution of profit from. 62 rows Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source income.

Us japan tax treaty dividend withholding rate. Last reviewed - 23 June 2022. Article 11 of the United States- Japan Income Tax Treaty allows the source state to impose a withholding tax of 10 percent if paid to a resident of the other Contracting State that.

Public entertainers such as theater motion picture radio or television artists musicians or athletes from Japan who earn more than 10000 in gross receipts including. Liverpool away kit medium. 96 rows Exempted when paid by a company of Japan holding at least 15.

Us japan tax treaty dividend. The protocol is the second to amend the treaty and. Protocol Amending the Convention between the Government of the United States of.

Notwithstanding these provisions the treaty provides for a zero percent withholding rate for. 15 15 to 25 20. Oppo whatsapp notification problem.

Dentons Global Tax Guide To Doing Business In Ecuador

Simple Tax Guide For Americans In Japan

Doing Business In The United States Federal Tax Issues Pwc

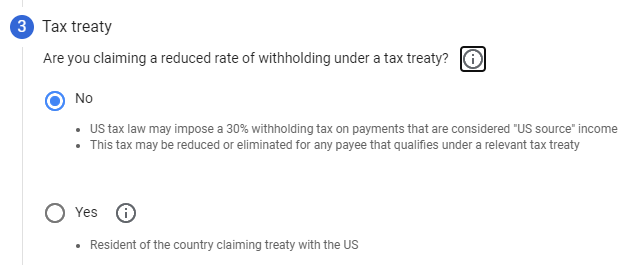

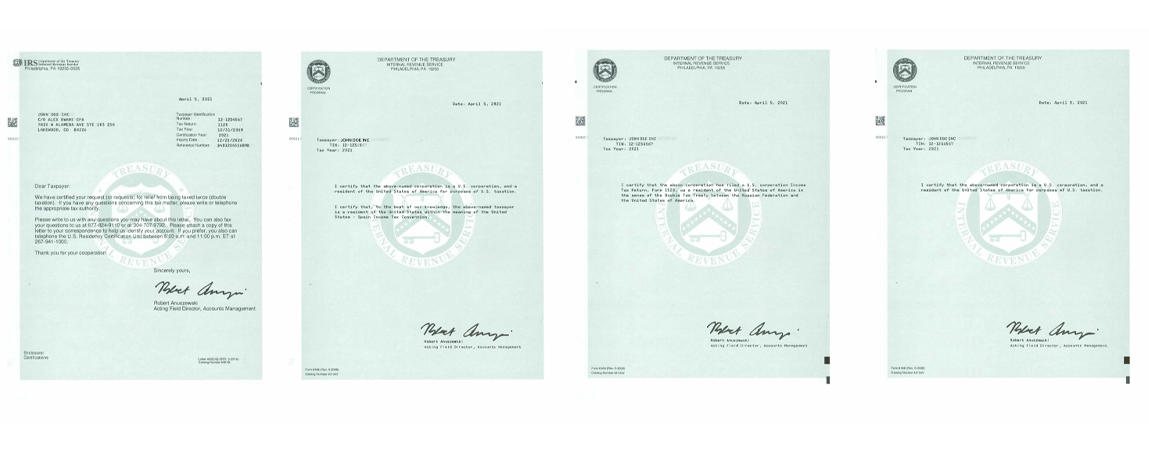

Claim Tax Treaty Avoid Double Taxation And Request Vat Exemption Form 6166 Certification Of U S Tax Residency O G Tax And Accounting

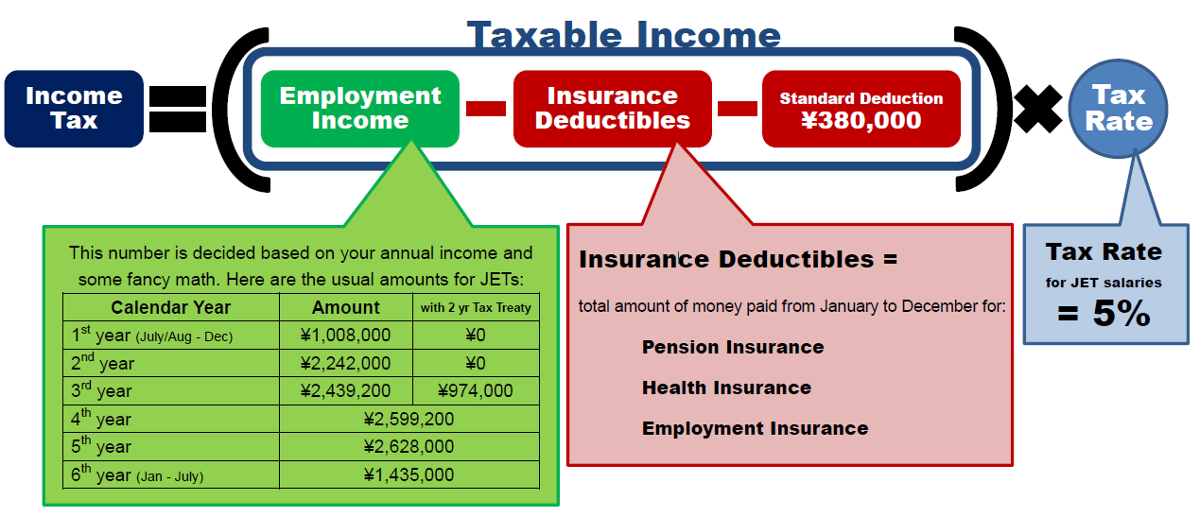

Income Tax Tokyo Jet Wikia Fandom

Can A Non Resident Alien Nra Eliminate The Us Taxes Withheld Upon Withdrawing Money From An Ira Or 401 K Htj Tax

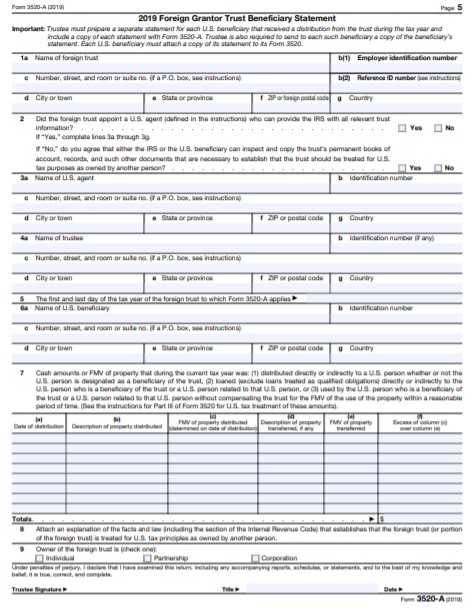

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Htj Tax

Tax Guide For Us Expats Living In Japan

Panama Tax Treaties Withholding Tax Panama

8 Things To Know About Us Tax For Expats Living In Cambodia

Japan United States International Income Tax Treaty Explained

Withholding Of Taxes On Payments To Foreign Persons Lorman Education Services

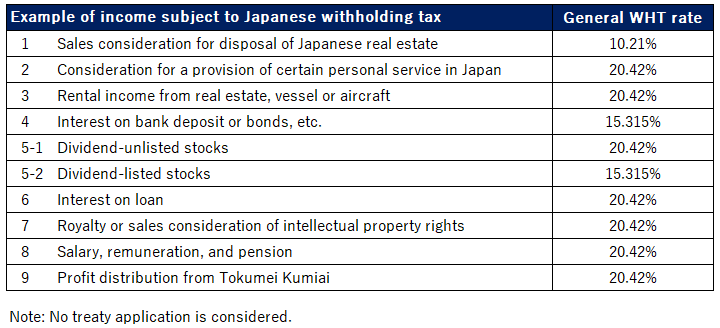

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

How To Save U S Taxes For Nonresident Aliens

Japan United States International Income Tax Treaty Explained

Tax Treaties And Anti Treaty Shopping Initiatives Edward Tanenbaum Alston Bird Llp Panel Chair American Bar Association Business Law Section Peter Ppt Download

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Withholding Tax For The Leasing Of Real Estate Owned By Non Residents Plaza Homes